mobile county al sales tax form

FIGURES MAY BE ROUNDED TO NEAREST DOLLAR. Mobile County Al Sales Tax Registration.

In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information.

. For tax rate information please contact the Department at 256-532-3498 or at salestaxmadisoncountyalgov. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions. Developers Price Value List.

Business License Renewals. Drawer 161009 Mobile AL 36616 251. 243 PO Box 3065 Mobile AL 36652-3065 Office.

Please print out the forms complete and mail them to. For inquiries and forms you should contact them at 251-208-7462. Since the property has been auctioned it must now be redeemed.

Leasing Tax Form 3. 8 AM - 4 PM Kay A Hart-Tobacco Tax Collector. Automate sales tax preparation and filing and get back to selling.

Joint Petition for Refund. Application for Developers Values. Food Beverage Tax Form 7.

Upon the proper completion of a Motor Fuels Gas Excise Tax Application pre-printed forms will be mailed out. Sales Tax Form 12. Mobile County property owners are required to pay property taxes annually to the Revenue Commissioner.

Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may call ALTIST Certified Auditors Complaint Hotline. Application for Current Use Valuation for Class 3 Property Return. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales tax.

CITYOF MOBILE POBOX 2745 MOBILEAL36652-2745 PHONE 251 208-7461. If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail. Petition for Release of Penalty.

Mobile County AL Sales Tax Rate. Petition for Release of Penalty. Tobacco Tax 1150 Government Street Room 112 Mobile AL 36604 251-574-8580 251-574-8599 FAX TobaccoTaxmobilecountyalgov Hours.

Seller Use Tax Tax Form 13. For a copy of our Lodging Tax report form click here. The purpose of the tax lien auction is to secure payment of delinquent real property taxes in Mobile County.

Restaurants In Matthews Nc That Deliver. Sales Tax Form 12. SALES USE TAX MONTHLYTAX RETURN.

The December 2020 total local. Mobile County collects a 15 local sales tax less than the 3 max local sales. Direct Petition for Refund.

SALES USE TAX MONTHLYTAX RETURN 12. For a copy of our Lodging Tax report form click here. For your research andor bidding needs.

Essex Ct Pizza Restaurants. You should contact the license office. Revenue Office Government Plaza 2nd Floor Window Hours.

Mobile AL 36652-3065 Office. Sales Use. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales.

PLEASE NOTE your assigned account number is to be used for all taxes reported such as sales use lease and lodging. Is this a final return Yes No. Reports for the City of Mobiles OTP should be filed and remitted directly to the City of Mobile.

As the property owner you are given a period of three 3 years to redeem the property with this office. Sales Use administers collects and enforces several different taxes including sales tax and consumers tax and is responsible for administering collecting and enforcing those tax types. Heres how Mobile Countys maximum sales tax rate of 10 compares to other counties.

Food Beverage Tax Form 7. Some cities and local. Joint Petition for Refund.

For tax information. My property was sold in the tax sale. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as 100 mail fee for decalsA mail fee of 250 will apply for customers receiving new metal plates.

Declaration of US Citizenship Letter - Form A. Business entities that file and pay Mobile County Sales Use Lease Automotive Lodging and Mobile County School Sales and Use Taxes should file and pay using the ONE SPOT system accessible through the State of Alabama My Alabama Taxes MAT website. Revenue Department 205 Govt St S.

Business Personal Property andor Personal Aircraft Return. The current total local sales tax rate in Mobile County AL is 5500. Sales Tax General Gross.

Declaration of US Citizenship Letter. A discount is allowed if the tax is paid before the 20th day of the month in which the tax is due. MONTH COVERED BYTHIS REPORT PERIOD COVERED BYTHIS REPORT From.

A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. 10 Auto 05 Consumers Use Tax General Gross. To obtain a payment amount for a delinquent tax account please contact our Collections Department at 251-574-8530.

If you have obtained a State of Alabama privilege license you may still need to add the tobacco section 73 to that license at a nominal fee. General rate 350. Delivery Spanish Fork Restaurants.

The current Mobile County Resolution levying the County Sales Use Lease and Lodging taxes may be found here. Our main office address is 3925 Michael Blvd Suite G Mobile AL 36609. Soldier For Life Fort Campbell.

NOTICE TO PROPERTY OWNERS and OCCUPANTS. Some cities and local governments in Mobile County collect additional local sales taxes which can be as high as 45. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

The Mobile County Sales Tax is collected by the merchant on all qualifying sales made within Mobile County. Declaration of US Citizenship Letter - Form B. However pursuant to Section 40-23-7 Code of Alabama 1975 th in order to file quarterly bi-annually or annually for that calendar year.

Instructions for Uploading a File. Returns can be filed by using one of the following options. Opry Mills Breakfast Restaurants.

The county sales use and lease tax levies parallel the State of Alabama Sales Use and Lease. You are most likely already paying your State salesuse taxes through ONE SPOT-MAT so you only need to add. Board of Equalization-Appeals Form.

1-334-844-4706 Toll Free. Income Tax Rate Indonesia. The Mobile County Sales Tax is 15.

The current total local sales tax rate in Mobile County AL is 5500. Leasing Tax Form 3. Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers.

Room Rental Agreement Template Real Estate Forms Room Rental Agreement Real Estate Forms Rental Agreement Templates

See More On Fake Reviews Problem Is Much Worse Than People Know Learning Techniques Search Marketing Online Marketing

Locations Mobile County Revenue Commission

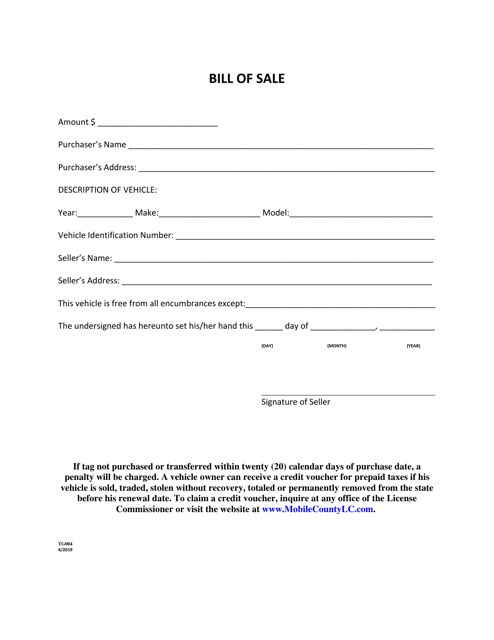

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Bill Of Sale Template Real Estate Templates

Locations Mobile County Revenue Commission

Locations Mobile County Revenue Commission

Forms Alabama Department Of Revenue

Mobile Social Security Office 550 Government St Social Security Resource Center

Licenses And Taxes City Of Mobile

Fire Chief Resume Examples Resume Examples Firefighter Resume Resume

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Free Alabama Vehicle Bill Of Sale Forms Fill Pdf Online Print Templateroller

Temporary Tags Alabama Department Of Revenue

Grimco Delivering Wholesale Sign Supplies Printing Equipment To The Mobile Area With Same Or Next Day Delivery Available